News

FCC improved its gross operating income (EBITDA) by 2.8% to 761.5 million euros in the first nine months of the year

FCC improved its gross operating income (EBITDA) by 2.8% to 761.5 million euros in the first nine months of the year

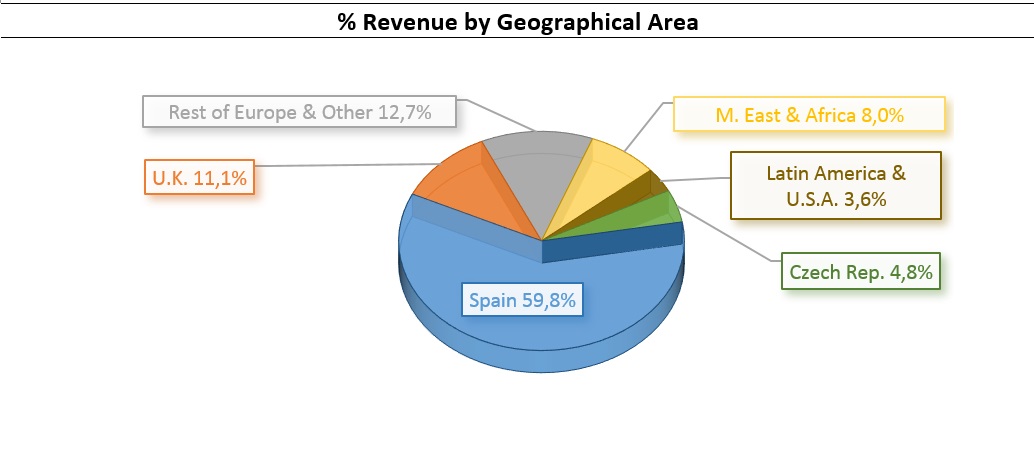

- The Group's consolidated income fell by 2.8% to 4,448.1 million

- Net operating profit (EBIT) amounted to 393.4 million euros in the first nine months of the year, compared to the 414.3 million euros obtained in 2019, which is a decrease of 5%

- Net financial debt fell by 13.8% compared to the end of the previous year, to 3,084 million euros

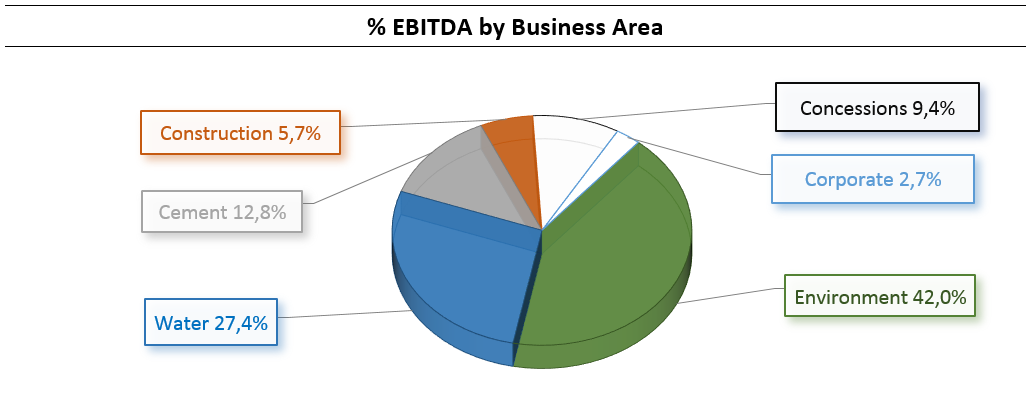

The FCC Group's gross operating profit (EBITDA) rose by 2.8% in the first nine months to 761.5 million euros. This represents an increase in the EBITDA margin to 17.1% compared to 16.2% in the same period last year.

The Group's consolidated income fell by 2.8% to 4,448.1 million up to September. This reduction is partly due to the measures introduced since March to combat the COVID-19 health crisis. Despite this, the utilities activities (especially Environment and Water) continued to perform well due to their nature as essential services, in addition to the Concessions area that increased its contribution to Group revenue after acquiring a majority stake in the Cedinsa Group in November last year.

Net operating profit (EBIT) stood at 393.4 million in the first nine months of the year, compared to the 414.3 million euros obtained in 2019, which is a decrease of 5%. This result shows the effect of the developments in gross operating profit together with the higher provision for amortisation corresponding to transport concession assets affected by operating activity following their entry into consolidation at the end of last year.

Even with the reduction in net financial expenses of 5.7% in the period, profit before tax totalled 299 million euros, a reduction of 22.5%, mainly due to the developments in exchange rate differences in the period.

Attributable net income reached 174.5 million, 25.1% lower than in the same period of the previous year. Adjusted for the aforementioned exchange rate differences, its development would have been -4.8% compared to the previous year.

As at 30 September, net financial debt fell by 13.8% compared to the end of the previous year, to 3,084.7 million euros.

The Group's revenue portfolio closed at 30,044.7 million euros at the end of the year, which still does not include significant contracts provisionally awarded in the Construction and Environment areas

Significant events

FCC Construcción will build a new hospital in the United Kingdom for 590 million euros

Last September, a consortium in which FCC Construcción participates was awarded the contract for the design and construction of a new hospital in Jersey. The design is valued at 26.4 million euros and the execution period will be one and a half years. The construction phase will then begin, valued at a further 550 million euros.

Other significant works awarded include the E6 motorway in Norway valued at 238.8 million euros. This is the first contract awarded in that country and includes the design and construction of a new, 25-kilometre section of the E6 motorway with a 47-month execution period. Special mention should go to the award this year of the design, construction and maintenance of section 2 of the Maya Train (Mexico), jointly with Carso Infraestructuras y Construcción (CICSA). The project consists of a 200-kilometre section valued at more than 700 million euros with an execution period of 28 months to which a further five years of maintenance has been added.

The FCC Group's environmental services area has strengthened its position in the United Kingdom with the entry of a financial partner

Last July, FCC reached an agreement with the investment group Icon Infrastructure Partners for the purchase of 49% of the capital of its new subsidiary Green Recovery Projects Limited, header and owner of five energy recovery plants for its Environment subsidiary in the United Kingdom, for an amount totalling 198 million pounds sterling. This means an appreciation in the value of the company, at 100%, of 650 million pounds including its debt. The recovery plants ("EfW") are located in Kent, Nottinghamshire, Buckinghamshire, Edinburgh and Lincolnshire. Final closure of the agreement is pending the corresponding regulatory approvals.

The head of the area, FCC Servicios Medio Ambiente Holding, will maintain control of the new subsidiary and its global consolidation, as well as a 50% stake in the incinerator in Mercia and a 40% stake in the one in Lostock.

FCC as licensee for the construction and operation of a motorway in the United Kingdom

FCC, through its company FCC Concesiones, has been selected for the extension of the A465 motorway in Wales (United Kingdom). FCC is part of the Future Valleys consortium together with other local and international partners. The project was developed under the PPP model and consists of doubling the current motorway. It is 18 kilometres long and represent a significant improvement to the connectivity and development of the region, with a planned investment of more than 600 million euros.

FCC has agreed to the sale of certain infrastructure concessions for more than 400 million euros

On 3 October, FCC agreed to sell its entire stake in three concessions located in Spain to Vauban Infrastructure Partners, within its policy of rotation and selective development of projects in this activity. These three concessions are included in the portfolio of the FCC Group, which has a stake in 14 transport infrastructure concessions. The agreement means the transfer of 51% in the Cedinsa Group, which manages the concession of four dual carriageways in Catalonia, 49% in Ceal 9, the concessionaire for section 1 of line 9 of the Barcelona Metro, and 29% in Urbicsa, the operator for the Ciudad de Justicia (City of Justice), also in Barcelona. The price to be paid by Vauban for all of FCC's stakes in these concessions amounts to 409.3 million euros and this will improve the Group's treasury position while enabling the deconsolidation of 690.7 million euros of net financial debt at the close of the third quarter. The closure of the agreement is pending obtaining the usual authorisations for this type of transaction.

In the first six months FCC has distributed a scrip dividend of €0.4/share corresponding to business year 2019

FCC's General Shareholders' Meeting, held on 2 June, approved the distribution of a scrip dividend. As a result, in that month FCC paid €0.40 per share month to those shareholders who chose to receive the company's scrip dividend in cash. It should be pointed out that 98.7% of the shareholders chose to receive the equivalent amount in new shares issued by the company. This is the second consecutive year that the FCC Group has applied this type of scrip dividend system, which the vast majority of shareholders use in its formula of new shares issued, which shows support for the Group's reinvestment and financial strengthening policy.

KEY FIGURES

| (M€) | Sep. 20 | Sep. 19 | Chg. (%) |

| Net turnover (NT) | 4,448.1 | 4,577.9 | -2.8% |

| Gross Operating Profit EBITDA | 761.5 | 740.8 | 2.8% |

| Ebitda margin | 17.1% | 16.2% | 0.9 p.p. |

| Net Operating Profit EBIT | 393.4 | 414.3 | -5.0% |

| Ebit margin | 8.8% | 9.1% | -0.2 p.p |

| Income attributable to equity holders of the parent company | 174.5 | 233.0 | -25.1% |

| (M€) | Sep. 20 | Dec. 19 | Chg. (%) |

| Equity | 2,634.7 | 2,473.8 | 6.5% |

| NET FINANCIAL DEBT | 3,084.7 | 3,578.7 | -13.8% |

| BACKLOG | 30,044.7 | 31,038.4 | -3.2% |